The end of the calendar year is sure to bring about predictions about the year ahead. Media sources are filled with prognostication. And Logistics Viewpoints has a history of its own supply chain predictions for the year ahead. My colleagues and I will likely publish a detailed list of predictions related to supply chain operations and technology. But today I would like to take a moment to review recent changes in supply chain barometers and apply a positive perspective on what these indicators suggest. The last few years have been anything but typical. Most notable is the extreme volatility in volumes, prices, and disruptions that have occurred. This volatility has increased public and corporate attention and appreciation for supply chain and logistics. This is surely a positive for the field. However, the volatility has also coincided with economic instability. I would like to put a stake in the ground and state that I expect (and hope for) a year of relative stability along with a “migration to the mean.” I believe that conditions are poised for a bit of a return to normal, with the supply chain function retaining its increased level of importance in the eyes of the public and C-level suites. Here are some data that support my view.

Supply Chain Volatility

The concept of supply chain volatility is difficult to measure and even more difficult to forecast, as disruptions are typically surprises. However, GEP And S&P Global publish the GEP Global Supply Chain Volatility Index based on data derived from S&P Global’s PMI surveys. A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The chart below shows that the index decreased to a value below zero earlier this year, for the first time since 2020. Furthermore, 2022 peaked out with values above 5, indicating extremely high levels of supply chain volatility. Most notably, item shortages (purple) and stockpiling (red) were large contributors to 2021-2022 volatility. Today these factors appear insignificant.

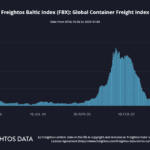

Container Shipping

There have been recent reports publicizing the rapid decline in container shipping rates. Of course, lower rates are great if you are paying for the service and not so positive if you are providing it. However, if one pans out and takes a longer-term look at container shipping rates, it becomes evident that rates are really more “normal” now than they were over 2021 and 2022. The Freightos Baltic Index: Global Container Freight Index shows that rates over the last six months are in-line with the historic average between 2016 and 2020. In reality, 2021 and 2022 rates increased by multiples of the average over the four prior years. Of course, prices tend to jump from supply and demand pressures. Therefore, I suspect that moderate changes in volumes exert more substantial effects on prices.

Price Inflation

Container prices was just the tip of the iceberg with respect to rapid price increases. In fact, general price inflation as measured by the consumer price index (CPI) and the producer price index (PPI) increased to the highest rates in decades. There was much debate (and still is some) about the “stickiness” of inflation, the delayed response by central banks, and then the economic impacts of the Federal Reserve’s aggressive monetary tightening. At this time, it appears that inflation has almost vanished, as we are close to the Federal Reserve’s target rate of inflation. With inflation under control, interest rate tightening will be less likely and loosening may even occur to support the economy if weakness occurs.

Final Word

Many of the supply-side constraints that occurred during the pandemic have subsided. Shifts in consumer behavior exerted additional pressures on supply chains. These shifts have reverted toward prior patterns as well. Together, the reversion of these patterns has assisted in inflation reduction. The rapid changes can be concerning but looking at data over the last 5 to 7 years shows that we are reverting back to “normal” patterns. I view this as a welcome occurrence. I believe that the supply chain function will retain its increased level of importance in an era of relative stability. The last few years will not be quickly forgotten.

The post 2024 Supply Chain Predictions – Relative Stability and a Migration to the Mean appeared first on Logistics Viewpoints.